Telstra in Tangles?

PPM’s view on the current state of Telstra

A discussion by Hugh MacNally, Chairman and Founder of Private Portfolio Managers

You may be aware of the recent press and broker commentary on Telstra, which has been universally negative. Telstra is a portfolio holding of PPM’s and one which we think is at an inflection point.

Much of the focus of all commentary has been on Telstra, which is rather strange because if Telstra is in pain then the other players are having their limbs torn off. One supposes that the focus is on Telstra because the information about Optus and the Vodafone/Hutchinson Whampoa JV is less accessible – their pain however is very real and this is the very point that Telstra is making when they slashed their mobile charges. This is very much a re-run of 2011 when as a new technology was coming in, Telstra turned the blowtorch on its competitors. One might remember that they won that battle comprehensively and the share price more than doubled. The situation this time is more in favour of Telstra as the others will remember what the result of the last bout was a knockout in the third round!

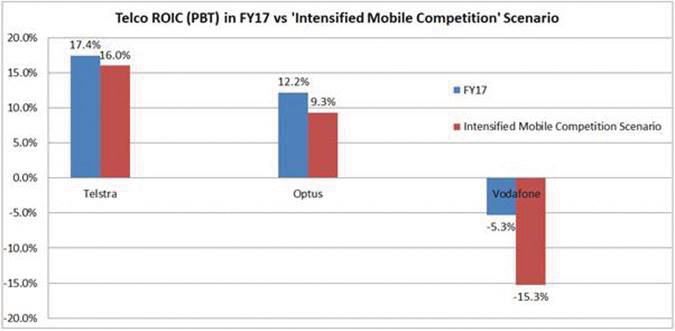

The weakest link in the chain is the Vodafone JV, which has rarely achieved profitability despite investing about $8 billion and if UBS’s analysis is right they are looking at a 15% negative return going forward.

This is at a time when the JV partners will have to go to their Boards and ask for funding for 5G capex and a few dollars more to buy spectrum. Australia represents 1% of Vodafone’s customer base in a low growth market – not a big part of their business. The new Vodafone CEO might like to clear the decks at the start of his tenure (a reasonable write-off) rather than sit with a suppurating sore – just a speculation.

Our view is that the revenue projections that are doing the rounds are far too pessimistic as the pressure on the other players, if the projections were correct, would be intolerable. One has to remember that this is a very high capex business with very high fixed cost, the result being that any improvement in revenue has a significant impact on profitability.

The current mobile ARPU (average revenue per user) of approximately $65/month equates to $2/day or half a cup of coffee. If the Baristas can edge the price of a coffee up, then the dominant operator in an oligopoly with a weak player and an underfunded new entrant should be able to also. Mobile phones and coffee are addictions that most people have; addictions are not price elastic.

PRINT THIS ARTICLE