As at June 2024

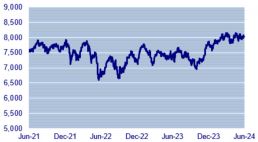

Equity Market Returns

Source: Capital IQ, MSCI

Overview – Hugh MacNally

Equity markets rose strongly for the financial year ending June 30, 2024. Global markets increased by 19.8%, as measured by the MSCI global index in Australian dollars, and 0.26% in the last quarter. The Australian market rose by 12.51% for the year, however, it experienced a 1.16% decline for the last quarter.

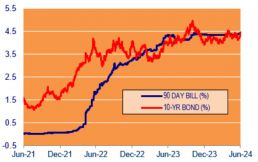

Short-term interest rates in Australia increased from 4.10% to 4.35%. The Reserve Bank has kept rates steady since November 2023, discussing whether to maintain or increase them, with no reduction considered. This stance contrasts with other central banks, such as the European Central Bank, which reduced rates, and the Federal Reserve, which is considering future rate cuts. Inflation appears more entrenched in Australia than in other key developed economies.

Bond yields rose from 4% to 4.4% for 10-year bonds, down from highs of nearly 5%. The US 10-year bond followed a similar pattern, though it was slightly higher for much of the last six months.

The Australian dollar ended the year at approximately 66.5 cents against the US Dollar, fluctuating between 63 cents and just above 68 cents. Against the Euro, the Australian dollar appreciated by 3%.

The financial year was characterized by fluctuating expectations of inflation and interest rates, ending with less optimism than mid-year, especially in Australia. Despite this, equity markets performed well.

Portfolio stock operating performance varied widely. The tech sector saw spectacular earnings increases across businesses in advertising, data centres, retail, and office productivity tools, with significant focus on AI. The financial sector, particularly insurance companies, reported improved results. Industrial companies like United Rentals in the US and

Redox in Australia also had good results. The agricultural sector had a challenging year, but this created attractive opportunities among quality stocks.

Global investments continued to concentrate in the US, where returns on capital have been significantly higher than elsewhere. In the domestic market, we favour distribution businesses and those in various parts of the energy chain.

International Equities

Hugh MacNally

International Equities Performance

Source: MSCI

International equity markets rose strongly during the year, increasing by 20.19%, although they softened slightly in the last quarter by 2.63%.

Earnings performance across several sectors was very strong, particularly in the technology sector, where the focus has been on AI and data centers. However, earnings in other parts of the business, such as advertising, retail, logistics, and productivity tools (e.g., Microsoft products), were also strong.

Financial services companies saw profitability improve, especially in insurance. Allianz Group’s return on equity, an important measure, rose to 17.4%, a strong result but difficult to maintain over the long term. Service companies like United Rentals (machinery and plant hire) experienced strong revenue growth, up 17%. In discretionary retail, Ulta Beauty (the largest distributor of beauty products in the US) continued its strong growth, with revenue up 7.6% for the year to May.

In healthcare, our largest holding is Merck & Co. Revenues continued to grow strongly, driven by the success of their dominant oncology drug, Keytruda. Moderna produced impressive results with their oncology vaccine. Intuitive Surgical continued its strong growth over the last five years, up 13.8% for the year to March 2024, reflecting the average growth over the past five years. However, its valuation already reflects this impressive performance.

Regarding stocks where the latest results did not show improvement but where we remain positive operationally, recent results have provided opportunities to buy at attractive prices. First is D.R. Horton, which has come off very high growth rates during COVID and has faced pressure from higher mortgage rates. We believe the medium-term outlook for the US housing industry is extremely attractive, and Horton is a premier operator.

Rockwell Automation’s growth was lower than expected a year ago, but this appears to be due to short-term factors, and we are happy to continue holding the company. We acquired stock in Deere & Company, the agricultural equipment manufacturer, on a counter-cyclic basis. Prices of major agricultural commodities have fallen substantially over the last two years, as has Deere’s share price, presenting an opportunity to acquire a high-quality company at a discounted price.

We are generally comfortable with the operational performance of the stocks held over the year, with the exception mentioned below. The valuations of some that have become cult favourites have been an issue.

Transactions over the year focused largely on valuations after a period of strong rises in the technology and medical technology sectors. We also progressively reduced exposure to the finance sector, where share prices have risen, and we are less optimistic about the returns banks and insurance stocks are likely to achieve compared to the pre-GFC period. Where prices have risen significantly, we have redeployed funds where we anticipate higher returns. Fortunately, there are opportunities to do this.

These include United Rentals and Ulta Beauty (both mentioned above), plus Kering, a French luxury goods stock that owns Gucci, Saint Laurent, Bottega Veneta, Balenciaga, Boucheron, and several other prestigious brands. Kering’s share price has been depressed by internal issues, but the strength of their brand portfolio is more important, making the price an end-of-season discount!

Notably, we sold holdings in Nvidia, which had risen to a level we felt was excessive. Similarly, we reduced positions in Intuitive Surgical on valuation grounds. Both are great companies, but their valuations no longer made sense. We also sold holdings in Lloyds Banking Group, Travelers Insurance, and reduced our holding in Allianz. While these stocks did not have the high valuations mentioned above, the combination of few growth opportunities and high price-to-book values made them unattractive.

Despite the sale of Nvidia, the portfolios retain substantial exposure to technology, adding during the year when prices were attractive. Below are comments on the five major holdings:

- Amazon (AMZN) saw robust growth from e-commerce and AWS, with Prime and advertising driving key gains. Investments in logistics and AI supported stock appreciation.

- Microsoft (MSFT) performed strongly due to Azure, Office 365, LinkedIn, AI, and gaming expansion, leading to excellent stock performance.

- Taiwan Semiconductor Manufacturing Company (TSMC) grew from high semiconductor demand across multiple industries, with strategic capacity expansions boosting revenue and stock performance.

- Alphabet (GOOG) achieved strong growth in digital advertising, cloud computing, and YouTube, with AI innovations driving significant stock gains.

- Meta Platforms (META) faced privacy and regulatory issues but grew its user base and advertising revenue, supported by metaverse and AI investments.

Despite the strong share-price rises, we are comfortable with the valuations. These companies have very high returns on capital and opportunities to invest at high rates of return.

In the finance sector, we retain holdings in Wells Fargo and UBS. Wells Fargo is well-placed to improve its return on capital, and UBS remains significantly undervalued.

A major disappointment during the year was Quest Diagnostics, the largest pathology provider in the US, where the economics of the industry have deteriorated for various complex reasons.

Australian Equities

Peter Reed

Australian Equities Performance

Source: Capital IQ

The Australian equity market delivered a flat result for the 3 months to June but rising 12.51% for the year.

Debate on the energy transition in Australia and globally has taken a prominent position for some time now, much of it ideologically driven. PPM has focused on the fundamentals and simply sought out opportunities that meet our return requirements. Early investments included a portfolio of coal miners: New Hope, Whitehaven and Stanmore. Each of these companies produce a commodity vital for the power generation and/or steel sectors. Importantly, they are each positioned at the low end of the cost curve at the time of acquisition share prices were exceedingly cheap.

Moving to this quarter, we established a new position in Origin Energy, one of the top-3 power generators in Australia. The company operates the largest fleet of gas fired power generators, placing it, arguably, in the best position to support the transition to renewable generation.

Underpinning the investment case is a tight energy supply/demand position, providing a favourable pricing environment for the sector. Coal fired power generation is due to be phased out by 2038, to be replaced with up to a 6-fold increase in grid-scale wind and solar capacity. This is a mammoth task, with the likelihood that there will be disruptions and timeline slippages. A base assumption is that electricity pricing will see upward pressure during this period and that the environment will favour incumbent generators. An indication of this is the recent agreement between Origin and the NSW government to extend the life of the Eraring coal fired power station in the Hunter Valley. As part of the deal, the NSW govt will limit Origin’s operating risk by underwriting a portion of any potential financial loss.

Further, as the transition proceeds toward intermittent electricity generation, volatility in pricing will increase. Origin is well positioned to take advantage of this by capturing more high-priced events with its flexible gas fleet. In this process, the company is expected to benefit from margin expansion, a position underpinned by its own long-dated, low-cost gas supply contracts.

At the same time, we envisage that electricity demand will receive a significant boost as technology use grows exponentially, supported by power hungry IT equipment, which is increasingly being located in data centres. Observing these trends, some forecasts point to US data centre electricity use more than doubling by 2030, pushing Data Centres (DC’s) to 8% of total US power demand versus 3% in 2022. Artificial Intelligence (AI) is an important component of this, as is the trend to electrification as economies decarbonise. Australia, although somewhat behind the US in these trends, will ultimately move in the same direction.

The conclusion from this is that the country will see a stepped change in electricity demand. Meeting this demand in normal circumstances is challenging, but coupled with the biggest energy transition in history, the challenge grows only bigger, implying higher pricing. Again, this is a situation that favours incumbent power generators and gives added duration to the investment case for Origin.

Following are summaries of three key holdings which hit some turbulence during the quarter:

Packaging company Orora indicated to the market that soft trading conditions were continuing in their North American packaging business as well as in newly acquired Saver Glass, which produces high end glass bottles, principally for the spirits and wine market. The company, in our view has been well managed over a number of years, as indicated by management decisions to exit the low growth/margin packaging business in Australia and investing in higher growth US packaging, retaining its quality Australian bottling operation and finally making the significant acquisition of French-based high end bottler Saver Glass.

We continue to be supportive of management’s strategy and take the view that the slowdown faced by the company is cyclical in nature and as stock levels are worked down throughout the supply chain more normal operating conditions will return. With the stock trading on a low-teen PE multiple towards the bottom of the business cycle, we assess current value of the stock as attractive, with expectations of delivering returns on capital above our hurdle of 10%.

Rural stock Elders similarly delivered a trading update indicating difficult trading conditions and again we view these factors as being largely cyclical or temporary. These included subdued client sentiment following earlier El Nino declarations by the BOM; significantly lower sheep and cattle prices as farmers reacted to these weather forecasts; and margin pressure in some key agricultural chemicals. Taking advantage of the price pullback, we added to portfolio positions.

The final company to mention in this group transport/logistics company is Lindsay. The company indicated that lower horticultural volumes caused by persistent wet weather as well as multiple rail disruptions, and disruptions to freight flows impacted the company’s second half trading.

Despite this setback, management indicated a confident outlook in the various market segments in which they operate. Favourable soil moisture and water storage in key irrigation regions point to positive conditions in the horticultural sector going forward. Refrigeration logistics will continue to be supported by demand from a growing population and changing consumption habits. Further, management is forecasting second half commercial freight volumes to grow 6% versus year ago.

The point in common with these companies is that we consider each as having a strong, profitable franchise, capable of delivering returns on capital well in excess of our hurdle rate. As they deal with the various cyclical factors each, we believe, will recover previous levels of return.

Finally, we take note of BHP’s decision to walk away from its bid for UK-listed miner Anglo American. This is the most significant bid by a long way undertaken by CEO Mike Henry, valuing the company at approximately $57 billion. We are naturally cautious on large scale acquisitions and view this decision favourably. We are far more comfortable with the company focusing on its existing high returning businesses, particularly iron ore, where capex can be efficiently deployed in brown field developments. Further expansion into so-called future facing commodities such as copper, nickel and potash may make strategic sense, but the final reckoning will be determined by return on capital invested and so this will be our point of focus.

Interest Rates

Neil Sahai

90 Day Bank Bill (%) vs 10 Year Bond (%) Performance

Source: Capital IQ

Since July 2023, US central bankers have maintained their policy rate within a target range of 5.25% to 5.5%. US Fed Chair Powell said, “the last reading on inflation, and to a lesser extent the one before it, suggest that we’re getting back on a disinflationary path.” The US economy has shown remarkable resilience amid high borrowing costs, though there are signs that the restrictive Fed policy is having an impact. Consumer spending has moderated, home sales have slowed, and there has been a broader cooling in labour demand. However, the unemployment rate at 4% remains a concern for policymakers. Expectations include two rate cuts this year, contingent on further evidence of a weakening labour market and continued disinflation.

In the UK, the Bank of England (BOE) left rates unchanged at 5.25%, describing the decision as finely balanced. Evidence of a slowing economy and inflation returning to its 2% target for the first time in nearly three years, suggests central bankers are edging closer to a rate cut.

The European Central Bank (ECB) has reduced rates by 25 basis points to 3.75%. With further rate cuts anticipated, the ECB is urging patience while gathering evidence that inflation is moving toward their 2% target.

In Australia, the Reserve Bank (RBA) has kept the cash rate at 4.35%. Most economists had predicted a hold with a downward move likely towards the end of the year, but the latest monthly inflation rate of 4% exceeded expectations of 3.8%. This data along with a persistent tight labour market has significantly shifted the outlook, indicating that further rate hikes may be necessary to meet inflation targets.

Property (REITS)

Franklin Djohan

ASX Property Graph

Source: Capital IQ

The A-REITs index declined by 5.63% during the quarter but still posted a strong 24.65% gain for the financial year. The majority of the constituents registered low to mid-teens declines for the quarter. Recent commentary surrounding the RBA potentially needing to increase interest rates to tame inflation has again spooked the A-REITs.

On a positive note, after challenging conditions last year for investment market activity, investor interest seems to have improved since the beginning of the year. The gap between asking and bid prices has started to make sense for both parties, mostly driven by the increase in capitalisation rates.

A series of asset write-downs have increased gearing ratios and could impact compliance with debt covenants. This explains the number of property disposals by listed players recently, with the proceeds typically used to pay down debt.

Dexus announced the sale of three assets for combined proceeds of $383.2 million, including two office towers (5 Martin Place Sydney and 130 George Street Parramatta) and an industrial asset located in South Brisbane (18 Motorway Circuit). Mirvac has divested circa $1 billion of assets, including the recent sale of 367 Collins Street in Melbourne, which is expected to settle in July 2024.

On the international front, Unibail-Rodamco-Westfield is in active discussions with potential buyers for more than €1.2 billion of assets across Europe and the US. Cromwell Property Group announced in May that it has sold six retail centres across Poland for €285 million.

On the other hand, Centuria Capital Group has acquired a $70 million subregional shopping centre (Halls Head Central) located 75km south of Perth’s CBD, with Coles, Aldi, and Kmart as the anchored tenants.

An increasing number of transactions will hopefully help the market with better price discovery and move toward more normalised conditions.

PPM is continuously looking for ways to improve the service we provide to you and your feedback is important to us. We hope are staying safe and healthy. Please contact Jill May, Head of Client Relationships with any questions, comments or suggested improvements at jm@ppmfunds.com or on (02) 8256 3712.

Private Portfolio Managers Pty Limited ACN 069 865 827, AFSL 241058 (PPM). The information provided in this document is intended for general use only and is taken from sources which are believed to be accurate. PPM accepts no liability of any kind to any person who relies on the information contained in this document. The information presented, and products and services described in this document do not take into account any individuals objectives, financial situation or needs. The information provided does not constitute investment advice. You should assess whether the information is appropriate for you and consider talking to a financial adviser before making any investment decision. Past performance is not necessarily indicative of future returns. © Copyright Private Portfolio Managers Pty Limited ABN 50 069 865 827, AFS Licence No. 241058.

Your Investment Management Team

Hugh MacNally

Portfolio Manager,

Executive Chairman

Peter Reed

Portfolio Manager,

Director

Franklin Djohan

Portfolio Manager / Analyst

Max Herron-Vellacott

Portfolio Manager

Neil Sahai

Portfolio Manager