Bad Headlines? What does the growing negative sentiment in the financial markets mean for SMSF trustees?

Insights from a Q&A session addressing the key issues that SMSF Trustees should be considering today.

Hugh MacNally,

Founder and Portfolio Manager

at Private Portfolio Managers Pty Ltd

and John Maroney, CEO, SMSF Association

You may have seen the increasingly concerning headlines from the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry hearings – highlighting poor governance and management practises of some of our largest domestic banks. Potentially more alarming, you may have also seen the headlines about the increasing negative sentiment towards the global financial markets outlook.

Global financial leverage is at record highs, “world debt reached 318 per cent of GDP at the end of 2017, 48 percentage points higher than the pre-Lehman peak.”1 The geo-political climate is uncertain with looming trade wars and increasing nationalism. In Australia, the stock market recently reached a 10 year high, wages growth has flatlined, the household debt is bulging and the air seems to be fizzing out of the domestic property market.

PPM recently participated in the SMSF Association Trustee Day in May in Sydney and heard these concerns expressed by many SMSF Trustees. They were wondering how these circumstances would affect them and what should they be doing to safeguard their SMSF portfolio. Hugh MacNally presented to the group discussing the current investment environment and addressed these concerns. Following that presentation, PPM participated in a Q&A session with John Maroney, and we wanted to share those insights.

PPM recently participated in the SMSF Association Trustee Day in May in Sydney and heard these concerns expressed by many SMSF Trustees. They were wondering how these circumstances would affect them and what should they be doing to safeguard their SMSF portfolio. Hugh MacNally presented to the group discussing the current investment environment and addressed these concerns. Following that presentation, PPM participated in a Q&A session with John Maroney, and we wanted to share those insights.

1. What do current investment market concerns mean for SMSF trustees?

Mr MacNally commented that over his 20 years at PPM there have been adverse investment cycles every 7-10 years, but, by applying a disciplined investment process he has successfully managed his clients wealth prudently through these periods.

“The present always has a more powerful effect on people’s thinking than the past, but one has to keep a perspective. We’ve been through a number of difficult periods and we will continue to have them – if you are 60 you will probably see another 3-4 major market downturns. It is unlikely that anyone will pick the start AND the end of them. But as John Templeton (one of the great fund managers of the 20th century) said “I never knew which way the market would go and I say after 40 years of investing it doesn’t matter”. We’d agree market timing is unreliable and what is important is a disciplined approach that allows you to navigate the inevitable downturns.

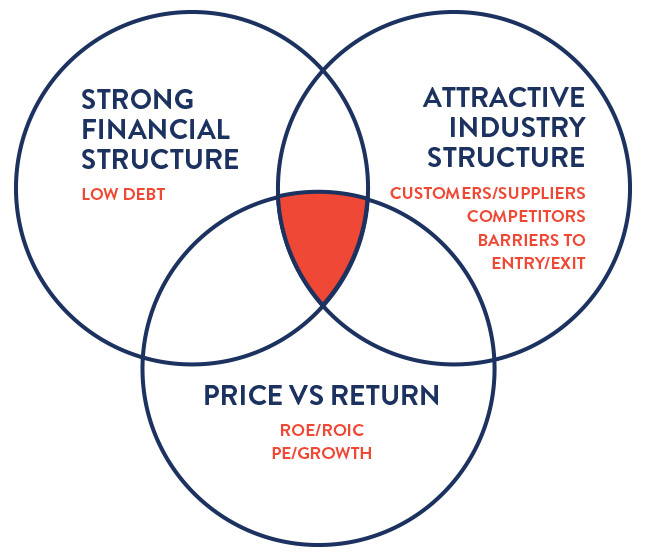

In this PPM focuses on three key areas, first, the financial structure of the company – companies that have low or no debt so they can survive difficult economic conditions and be in a position to take advantage of others folly. Second, we look at the price vs the underlying return that the company generates. If the company is generating a sustainably high return on capital and assets we can pay more for it and remain confident that we will produce an attractive return for investors. If the price paid does not reflect this then the result ultimately will not be a good one. Highly priced popular stocks are a road to ruin. Finally, we look for an attractive industry structure. This is an indicator of the durability of the company’s return. Michael Porter’s seminal work on competition theory provides us with a framework for this. The company has to be more powerful than its customers and suppliers, there needs to be barriers to entry and there needs to be rational competition, and finally there needs to be few barriers to exit (this is often forgotten – you don’t want a competitor that is compelled to remain and competing irrationally).

These three criteria we believe cover the major risks: financial collapse, adverse change in pricing and high business risk resulting in low returns.”

These three criteria we believe cover the major risks: financial collapse, adverse change in pricing and high business risk resulting in low returns.”

Mr MacNally continued, “so it is the narrow overlap of these three criteria that illuminates for us, and our clients, investments that will not only thrive but survive in adverse market circumstances. There are of course, times when we cannot find good investment opportunities (usually price related) and it is then that we will not invest but patiently wait to seek out truly attractive opportunities. Often it is adverse markets where good companies can be mispriced that present these opportunities.”

If anybody would like to explore these matters more then they might like to look at the some of the papers and references on our website.

2. What do SMSF trustees want today?

Mr Maroney commented that “Not only in 2018, but I recommend trustees gain specialist SMSF advice in conjunction with their own education and research. In a volatile market it is recommended to diversify investments to help ensure a sound investment strategy. Trustees’ investment strategy should be tailored to their specific circumstances to suit their financial and retirement goals and SMSF Specialist advice is important in helping achieve that goal.”

Mr MacNally commented that “PPM understands that SMSF trustees needs depend on the individual. We provide individual attention to and understanding of these needs, circumstances, risk profiles and investment requirements. Particularly in the current environment, SMSF trustees want to know, to be able to trust that their portfolios are being managed in a risk responsible way by a professional investment team that they have met, not invested in a bunch of unit trusts, ETFs and a couple of direct holdings.”

He noted that PPM does not chase returns but applies a clear and disciplined investment philosophy with a simple and transparent investment and fee structure. “We are looking to invest our client’s money in companies with a strong survivor bias that will provide solid returns over investment cycles not one, two or three years. There are few winners in trading or trying to pick the market, what you want is a disciplined approach of analysing and investing in good businesses that will be here for the long term and provide good returns for our clients.”

3. What are the key trends impacting SMSF trustees? And how should they respond?

3. What are the key trends impacting SMSF trustees? And how should they respond?

Mr Maroney commented that “The main trend still impacting SMSF trustees is the implementation of legislative changes effective last year as at 1 July 2017. This has far reaching effects, not only on the day to day administration of their fund but also estate and succession planning. There are many moving parts that trustees need to consider and for that reason it is vital that they seek SMSF Specialist advice to assist them. We see wonderful results when trustees are working in sync with their trusted, professional advisors.”

Mr MacNally commented that PPM is a specialist investment manager “what we do best is prudently managing our clients investments”, we work collaboratively with our clients’ advisers and accountants. We have been able to assist our clients work through changes in the legislative environment and the IMA structure has made is possible to easily assist clients with any $1.6m cap issues.

4. What challenges do you see facing SMSF trustee advisers in the next 5 years?

Mr Maroney commented that “over the next 5 years we see a few challenges that both trustees and advisors will be facing. One of these challenges includes the implementation and management of transfer balance account reporting. This is an issue that will have a substantial impact on SMSF administration and will need to be closely monitored as part of day to day fund responsibilities.

Another challenge is the diversification of investment portfolios to ensure a robust investment strategy and the ability to minimise unnecessary risk to achieve long-term goals.

The potential uncertainty in superannuation, including the recent franking credit policy debate and the integration of retirement income policy, is also a constant challenge that the sector faces.”

5. What direction do you see the SMSF Association heading in over the next 12-18 months?

The federal election, which will inevitably happen in the next 12 months is a big focus for the SMSF Association. “We’ll be looking at the general issues but also focussing on the budget and of course the threat from Labor’s franking credits proposal which very much targets SMSF trustees. We will be informing trustees and our clients we strongly oppose this proposal and running up to the election this will be a much bigger issue” said Mr Maroney.

Mr Maroney commented that “the SMSF Association will also be focussing on education in the next 12-18 months and will look at how we can work with higher education providers a lot more closely. We are all waiting to see what FASEA finalise in terms of guidance in the next few months and we will look at revising what we do in the higher education space.”

Mr. Maroney concluded that, “of course what will happen post Royal Commission findings will determine how we go about doing this. Trustees and investors need to be informed about best practice.”

PPM is a specialist provider of SMA & IMA solutions

PPM is a specialist IMA boutique investment manager with over 20 years’ experience in successfully managing individual and Trustee client portfolios to meet the demands of these sophisticated investors who want a tailored investment solution to meet their investment requirements. PPM first developed IMA’s in 1995 as a direct actively managed and administered investment solution for our sophisticated clients. In 2017, we launched the Australian Equities Growth SMA and the Global Equities Growth SMA, for both general and superannuation investment, to meet the growing demand for actively managed direct Australian and International portfolios of clients either do not require individual portfolio customisation or who do not satisfy the Corporations Law definition of a ‘wholesale’ investor.

For over 20 years PPM has applied its professional investment management expertise to work diligently to meet these needs tailoring and managing Individually Managed (IMA) portfolios of Australian and Global equities to help SMSF trustees grow their wealth and reach their investment objectives.

SMSF Trustees are attracted to PPM’s IMA and SMA solutions as they provide professional investment management, cost effective administrative ease and the transparency and control that astute SMSF Trustees demand. Super and non-super IMAs can be combined to assist our clients achieve tax efficient outcomes for their ‘total investment portfolio’.

We would be happy to meet with you to discuss your requirements to determine in conjunction with your advisers whether a PPM IMA or SMA is suitable for you. Contact us at ppm@ppmfunds.com or 02 8256 3777

Print this whitepaper