Australia’s Achilles Heel?

A discussion of the Risks for Index Funds and their heavy exposure to the Banking Sector by Hugh MacNally, PPM CIO and Founder

This article follows an earlier article in the May PPM Insights Index Funds – the untold risks. It points to the concentration of risk in two industries; resources and banking, both of which are themselves risky and asks the question, what would happen if the GFC style banking crisis were repeated in Australia?

To recap, the Australian equities market is very poorly diversified with two industries, finance and resources representing 50% of the ASX300 (a common index fund basis) and the top 10 stocks representing 42% of the total capitalisation, a very high proportion. The concentration is higher than most developed country markets. The arguments for index or “passive” investment has been that the no manager beats their benchmark consistently.

Does investing in a mechanical and simplistic fashion produce better returns at acceptable risk?

We are used to seeing resource stocks move in a volatile fashion, BHP dropped from $50 to $15 and Rio from $140 to $40. They tend to bounce back again when circumstances change as we have seen in the last year. However, in industries like banking, the other big sector in the Australian market, when there is a crisis of the magnitude of the GFC exposed banks go down and stay down with the share prices not recovering to previous levels for a generation.

So, what would be the effect on the Australian index funds of a GFC style event in the Australian banks?

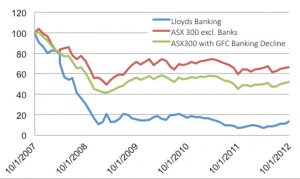

The graph below represents what would happen if the current composition of the market suffered a major crisis. For the purposes of this exercise we have used the movements of Lloyds Banking Group as representative. Lloyds business is not vastly different to the four large Australian banks; during the GFC it lost 90% of its value. Shown in the green is what would have happened to the ASX300 if the Australian Banks had declined as Lloyds did during the GFC. For most of the time the index would have been 15% lower and would have been 50% off the previous five years.

ASX300 With Banks in GFC Decline

It could be argued that this is a trivial exercise, it is what happens when you reduce 27% of a portfolio to near zero. What we would point out is that banking crises are not uncommon and their effects are long lasting. In my career, so far, as an investment manager there have been three.

Of course banking is a critical industry in any economy and as a result is both supported by government in a crisis and also heavily regulated, but essentially at its core it borrows short and lends long and on that mismatch lies its weakness. While government regulators will do anything to maintain the integrity of depositor’s assets, depositors being a protected species (to do otherwise would be disastrous and involve the breakdown of an economy). The equity holders on the other hand will generally lose all or nearly all their money. Governments may step in and provided capital to keep the institution operational, as in the case of Lloyds, or not, as in the case of Lehman Brothers in the US. Either way the original equity holder’s investment is largely gone. My point is that the value of these companies is far more brittle than for the wider market.

This we feel is the risk inherent in index funds; they do not make any judgements about risk in the sense of the companies’ underlying financial, business and pricing risk. The substantial inflow into index funds in Australian, as there has been globally, makes the market quite illiquid as a large proportion of investors are all doing the same thing. Where an index carries these risks to excess through its composition, its lack of diversification, the investor carries them as well. You can manage risk but you can’t manage performance, perhaps a bit of the former is better than singular focus on the latter.

Whether the Australian banks navigate the risks inherent in their asset concentration, their high leverage and the level of indebtedness of their customers, only time will tell, but do I want to mechanically put 27% of my portfolio in this sector? The answer to that is, no.

Print this Article