Interest rates have gone down

Hugh MacNally, PPM Chairman and Portfolio Manager discusses the importance of interest rates in valuation of assets as the central banks continue to increase cash rates.

Interest rates are of great importance in valuation of assets. Central banks continue to increase cash rates despite the issues that have arisen in the US regional banking sector (more on that below).

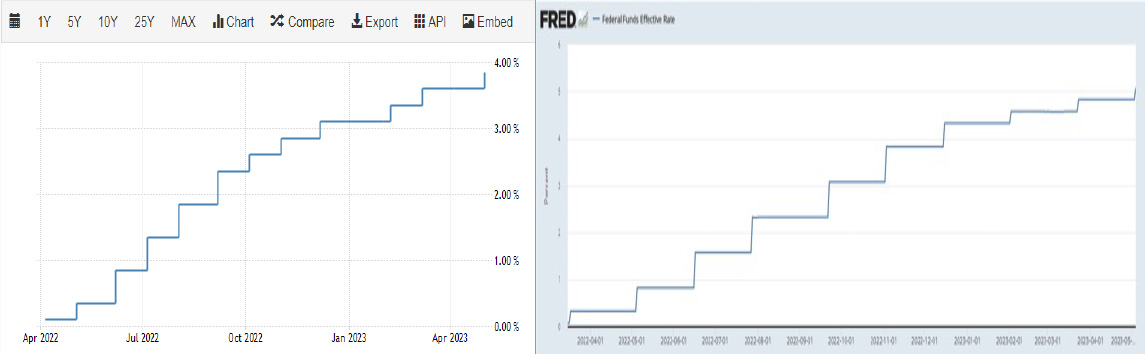

The chart to the left shows the Australian cash rate over the least year. To the right is the US cash rate over a similar period. Both show the rise from near zero to 3.85% in Australia and 5% in the US. Source: Trading Economics, FRED.

While cash rates have increased, the same is not true of both short and long terms bonds. As can be seen in the charts below the 2 year bond yields in Australia and the US are well below their recent highs and in Australia at about the same level as they were a year ago. In the US they are the same as they were in September 2022.

Source: DR Horton Q4 2022 Report

It could be interpreted that the market’s view is that inflationary pressures are coming under control and that in a reasonably short period of time they will be considerably lower. In the major league (the US) the 2 year Note yield is over 1% below the cash rate. The usual caveats apply; its foolhardy to predict economic outcomes, although betting against central banks give you better odds. (As a left of field comment, one might ask why the setting of interest rates does not go the way of fixed currencies, which were freed to set their own level (in Australia) 50 years ago. Would anyone go back to a managed exchange rate? The history of Governments setting prices and wages is uniformly awful, why should it be any better for interest rates (the price of money). The RBA Governor might like to be relieved of the impossible task of setting rates.

Back to latest victim of interest rate policy, the US regional banking sector. The price of bank stocks has come down in response to the failure of Silicon Valley Bank and a number of other regional banks, however, we think that the problem is narrowly confined and does not apply to Australian banks or indeed the major global banks in the US and the UK.

The problem for the regional banks arose out of the long duration of US mortgages, which are fixed for long periods (up to 20 and 30 years) together with investment of un-lent deposits in securities of long duration. Mostly the assets were of high quality, however, the liquidity mismatch became terminal when online withdrawals went viral.It is a cautionary tale when a 50-year-old bank with a spotless history of prudent lending is destroyed in a matter of days by online deposit withdrawal. It brings a new meaning to being cancelled! (The late Sir Les Patterson was not alone).

Interest rate rises discriminate; while for the mortgage holder, they cut household budgets and adversely affect consumption, for the unmortgaged (that is about 50% of Australian houses) they have little effect, or in the case of retirees with cash the household budget improves. Gone are the complaints that the bank pays them nothing for their deposits (if that is still the case perhaps, they should call their advisor for a better deal). Additionally, if they own an investment property there has been a tidy jump in rents.

The Bank of Mum & Dad is doing pretty well from the control of a scarce resource (housing) and cash on deposit. Not to mention their super has had a cracking FY2023 so far. Perhaps discretionary spending stocks with 50+ customers might be worth a look. A trip to Harvey Norman* or JB HiFi* for a new plasma TV and a new couch to watch it from? Or a cruise/tour bought from Hello World*? That’d be giving central bankers the bird.

Our contention is that using broad economic predictions as an investment tool misses the subtleties and variations important in investing. They also have completely the wrong timeframe; Recessions tend to be short, so if you are pessimistic, you have to be nimble to change course at the right time – often a difficult thing as bottoms mostly occur when the news is most bleak.

*The author is CIO of Private Portfolio Managers, which holds these stocks in its domestic portfolios.

For further information on Private Portfolio Managers Pty Limited (PPM) and our service offering please contact Jill May, Head of Client Relations or your Portfolio Manager on (02) 8256 3777 or jm@ppmfunds.com