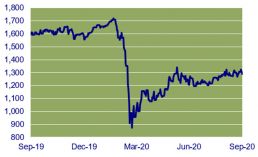

As at September 2020

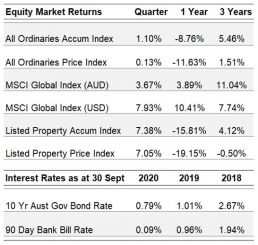

Equity Market Returns

Source: IRESS

Overview

Economies are recovering and have not suffered the depth of downturn that was widely predicted six or seven months ago. The September economic growth figures which will start to be released shortly will show very substantial growth from the previous quarter (which bore the brunt of the virus decline), although will still be negative for the last twelve months, with the exception of China. The large growth figures will perhaps act in a psychological way to purge some of the pessimism that has been felt over most of this year. It would seem that the recovery to annual economic growth will probably be quicker than was predicted at the start of the year.

Of great importance to key sectors in the economy, particularly in Australia, predictions that residential housing prices would collapse seem more remote as time goes by. It might be remembered that declines of up to 30% were used as the worst case. What has in fact happened is that prices have been stable or slightly down in most regions (and up in some). The importance of this is the security held by financial institutions over so much of their loan portfolios being residential real estate is that this security has remained intact. Banking systems remaining well capitalised will be beneficial to economic recovery.

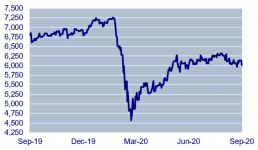

As was observed in the June Quarterly Report, while the market has recovered rapidly, it has been driven by a rapid escalation of prices in technology stocks, the broader market has participated only partly and in a number of sectors, finance in particular hardly at all.

There are obvious industries where recovery will take a long time and capital and confidence will be required, these include: tourism, airlines and hospitality. Additionally, CBD property has had a sharp drop in rents and occupancy contrasts with expectations that existed less than 12 months ago. It will be interesting to see if the work from home trend is long-term or is an aberration (one suspects productivity with long periods at home is low in the main).

International Equities

International Equities Performance

Source: Morgan Stanley Capital International

The movement in global markets, as measured by the MSCI (in A$) , were 3.7% for the three months to 30 September and 3.9% for the last twelve months.

We retain the view, expressed for some time, that markets are in a highly speculative phase with valuations in the technology and a number of other sectors quite excessive and reminiscent of the technology bubble 20 years ago. This contrasts sharply with much of the rest of the market where valuations are low or extremely low.

PPM’s approach is to focus on investments where the pricing is attractive relative to the underlying returns on capital that we estimate the investment will generate in the medium to long term. At present there are many opportunities, as valuation is out of favour and the sorts of stocks that PPM seeks to acquire are shunned in favour of speculation.

The banks and insurance companies held in the portfolios (Lloyds, Wells Fargo, Allianz, Travelers and Ping An) have been treated particularly harshly by the markets over the past year although the very negative economic outcomes that were predicted at the beginning of the crisis have not occurred. They retain the high levels of capital they started with and the predicted declines in value of the security over much of their loan books has not come to pass either. As commented earlier residential real estate which backed much of the banks’ lending has proven very resilient. Valuations of the banks remain at extremely low levels and are at large discounts to book value. The insurance sector has fared slightly better, particularly Allianz, but we see the pricing making them extremely attractive long-term investments.

Among the consumer staples, Nestle and Kraft Heinz, improvements in operations are continuing at Nestle and signs are also appearing at Kraft Heinz. The latter was bought at such a discount we feel comfortable in being patient. Neither company was adversely affected by the sharp economic downturn.

The pharmaceutical sector investments remain attractively priced particularly Merck & Co Inc and Bristol-Myers Squibb, which have large and growing oncology franchises. Similarly, in diabetes medicines Eli Lilly and Novo Nordisk have dominant shares of a growing market. The latter has had an unexpectedly good year, despite Covid-19 headwinds. Stryker Corporation, a robotic surgery and implant company, has had a substantially better year than might have been expected given the drop in procedures and while we are expecting a short-term drop in earnings this year a very strong recovery appears underway.

US home builder, D.R. Horton has had an extremely strong year, with volumes and prices for homes up; the level of home construction seems anachronistic given the negativity that the market feels for banks. We don’t quite know how to explain a strong housing market and a negative view of home lenders.

In the technology sector we have been reducing the exposure to Microsoft which was bought when the valuation was attractive, however the price rises this year has meant that this valuation is very stretched. It must be remembered that Microsoft is a very mature company and revenue is only growing at 10%p.a., a very respectable level, but not one where extraordinary valuations can be justified. We have replaced this with investments in two US mobile telecom stocks: Verizon and AT&T, the valuations are in our view attractive and the industry structure has improved as a result of the merger of the 3rd& 4th players (much like Australia).

We feel that the global portfolios stocks are well placed and avoid the risks associated with excessive valuations which will inevitably revert to more normal levels as they did post the 2000 tech bubble. It might be observed that it took the tech heavy Nasdaq Index 15 years to return to the high at the end of the 2000 bubble. The companies held in the portfolios are modestly valued and have strong positions in their industries and are unlikely to suffer this fate.

Australian Equities

Australian Equities Performance

Source: IRESS

Following strong gains in the previous quarter, Australian equities marked time in the third quarter rising just 1.1%.

Full year earnings results were a feature of the market during the quarter. The COVID-19 crisis was the overriding factor, of course, and thus rather than providing guidance on expected business performance the standard approach for most companies was to withdraw guidance on the basis there was too much uncertainty. A selection of companies provided useful insights for the way forward.

CBA was the only major bank to report during the period. Although not generally held in PPM portfolios, it does provide insights into how the banking sector as a whole is performing. As with the other banks earlier, CBA upped its provisions in anticipation of the economic impact from COVID-19. The point we would emphasise is that the level of provisioning was done on the basis of a very conservative set of assumptions: GDP to fall by 6% over the calendar year, unemployment to peak at 10% and house prices to fall by 11%. Six months into the crisis the assessment, including that of the recently released budget, suggests that the downturn will not be nearly as severe as these assumptions.

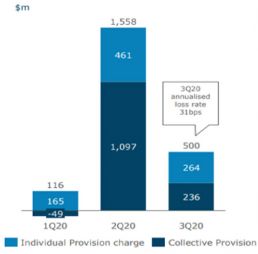

To this point, although the other 3 large banks did not report earnings during this period, they did provide quarterly updates on their business and standing out for us was a sharp decline in provision charge in the September quarter compared to the previous quarter.

ANZ Provision Charge: 1Q – 3Q FY2020

Source: ANZ

ANZ bank is illustrative, where its charge of $500 million was down by 2/3 compared to June quarter charge of $1,558 million. Early evidence, in our view, that the banks have very conservatively provisioned for the downturn and may well be in a position to make write backs in periods ahead, providing a profit tailwind. The banks on our estimates are trading cheaply with share prices below book value, whilst having attractive prospects for re-rating on the back of better than expected earnings.

Resource companies have to date navigated the COVID-19 crisis largely unscathed. Diversified miners Rio and BHP have taken advantage of extremely strong iron ore prices while incrementally lifting production levels to an annual rate of 300 million tonnes per annum. With an iron ore spot price of US$120 per tonne against a cash cost of production of less than US$15 per tonne, both companies are producing very high rates of return in this segment of their business (ROCE 64% for Rio; 50% for BHP). Given the importance of infrastructure programs in key markets in Asia, including China, strong demand looks set to continue for this key steel making ingredient, although pricing may pull back as production constraints are alleviated in the other key producing country, Brazil.

Newcrest was the other resource stock to report and is also benefitting from near record high prices, this time for gold. With an overall cost of production of $862 per oz, the company is generating very high profit margins and in turn producing attractive returns on capital of 13.8%. The gold producer continues to provide a good hedge against financial instability and inflation, in our view.

Elders – rural services – is benefitting from a lifting of the drought across eastern Australia and where 1H20 profits grew 25%. Buoyant conditions across the rural sector point to a continuation of strong conditions into the second half.

Woolworths, which outside its hotels business, is performing very strongly. The key Australian Food division saw sales growth of 6.3% for the year – a high level of growth for a grocery retailer – as consumers looked to home dining. Overall group EBIT after significant items grew a healthy 11.8%.

James Hardie has continued to grow market share in its key US market. Profit growth, likewise, has been healthy, registering double digit growth in the US whilst profit margin remains at 29%, a particularly high level for a building products company.

Companies facing headwinds in this period include: Telstra, which due to COVID-19 reported lower income from roaming and delayed some of its cost out program. This has put a question mark around whether the company can maintain its dividend pay-out.

General insurer IAG made refunds to customers across a number of insurance lines to reflect the reality of a difference in the way people are living and operating. An example of this is home and contents insurance, which because of the number of people working from home reduces risk of losses, say from house theft. Uncertainty over the question of liability for business interruption has also weighed on the industry both here in Australia and globally.

Our general comment is, we remain comfortable with these holdings and view the longer-term business prospects as positive, and view their stock valuation levels as attractive, these are both key ingredients for attractive investment returns for the long term.

Although there may be pockets of overvaluation in the market – technology, healthcare – the portfolio’s discipline of focusing on value positions it well for a recovery in the market whilst protecting against the downside.

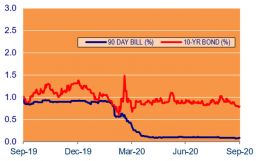

Interest Rates

90 Day Bank Bill (%) vs 10 Year Bond (%) Performance

Source: IRESS

With the COVID-19 virus continuing to spread worldwide, governments are expanding fiscal policy while central banks are maintaining extraordinarily accommodative monetary policy and quantitative easing programs. These are all aimed at reducing the economic contractions resulting from the pandemic.

At its most recent meeting, the Reserve Bank of Australia (RBA) Board maintained its current policy settings of a cash rate and a 3-year Australian Government bond rate at 0.25%. Interestingly at the time of writing, the 3-year Government bond rate was 0.13% and the last time the RBA bought bonds was early September.

The RBA’s “policy package is working as expected and is underpinning very low borrowing costs and the supply of credit to households and businesses”. It is clear the Bank has substantial scope to expand its balance sheet if required.

The RBA Board concluded its statement as follows, “addressing the high rate of unemployment is an important national priority. It will maintain highly accommodative policy settings as long as is required and will not increase the cash rate target until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2-3 percent target band”.

In the United States, the Federal Reserve (the Fed) is still very cautious about the outlook for the economy but maintains its goal of 2% inflation and it expects to maintain an accommodative stance of policy until this is achieved. The Fed left the target range for the federal funds rate unchanged at 0 to 0.25%.

The European Central Bank (ECB) maintained interest rates at 0.0% at its September meeting, and like its counterparts in the US and Australia, expects them to stay at this level until inflation reaches an acceptable level. In the meantime, it will maintain its asset purchasing program for as long as it is necessary.

Property (REITS)

ASX Property Graph

Source: IRESS

The A-REIT index rebounded strongly in the quarter, registering a 7% improvement from the prior quarter. However, there was still a divergence in terms of underlying market performance as the pandemic is changing people’s preference to work and stay closer to home.

The market in office space in major CBD’s like Sydney and Melbourne remain uncertain, with a large proportion of the workforce still working from home. In CBD markets, larger incentives from landlords are pulling effective rents down, even though headline rents seem to be holding up. However, the suburban office market seems to be more resilient, as typically parking is more readily available making it easy for people who do not need to come to the CBD area, but also cannot conveniently work from home, as an option to work from these smaller fringe-suburb offices. As more companies seek cost-effective solutions for their employees and provide the flexibility that employees are now demanding, a lot of office REITs are now trying to position themselves to have a quality metropolitan location as part of their property portfolios. Singapore’s Keppel REIT bought three office towers at Macquarie Park in Sydney’s north-west from Goodman Group for $306 million in September. This was followed by another transaction from Singaporean property investor, Ascendas, buying an office building development also in Macquarie Park for $167m.

A similar situation is echoed in retail property, with people opting more toward local/neighbourhood type shopping centres. While foot-traffic in larger shopping centres like Westfield has rebounded, there are still a lot of uncertainties, mostly in relation to the discretionary retailers. However, the supermarkets and non-discretionary retailers that underpin neighbourhood centres have performed well. Likewise, retailers catering to home improvements have also been resilient, which bodes well for the large-format retail shopping centres. There is a rush to acquire these types of shopping centres as more and more people stay working from home. One of the listed companies that participates in this arena is Home Consortium, which we recently included in our portfolios.

PPM is continuously looking for ways to improve the service we provide to you and your feedback is important to us. We hope are staying safe and healthy. Please contact Jill May, Senior Client Relationship Manager with any questions, comments or suggested improvements at jm@ppmfunds.com or on (02) 8256 3712.

Private Portfolio Managers Pty Limited ACN 069 865 827, AFSL 241058 (PPM). The information provided in this document is intended for general use only and is taken from sources which are believed to be accurate. PPM accepts no liability of any kind to any person who relies on the information contained in this document. The information presented, and products and services described in this document do not take into account any individuals objectives, financial situation or needs. The information provided does not constitute investment advice. You should assess whether the information is appropriate for you and consider talking to a financial adviser before making any investment decision. Past performance is not necessarily indicative of future returns. © Copyright 2020 Private Portfolio Managers Pty Limited ABN 50 069 865 827, AFS Licence No. 241058.

Your Investment Management Team

Hugh MacNally

Portfolio Manager,

Executive Chairman

Peter Reed

Portfolio Manager,

Director

Ian Hardy

Portfolio Manager,

Director

Franklin Djohan

Portfolio Manager

Max Herron-Vellacot

Analyst

Neil Sahai

Dealer / Analyst